Given that Same Day Loans is not a lender and does not take part in any way in making credit decisions, we can only provide the users of this website with general rules regarding the rates and fees associated with a particular short-term loan product or offer. Same Day Loans is working only with lenders who strictly adhere to the international, federal, state and local regulations and laws and exercise fair credit practices.

Before applying for any short-term loans and engaging into any borrowing relationship, Same Day Loans strongly advises its clients to double-check the following aspects:

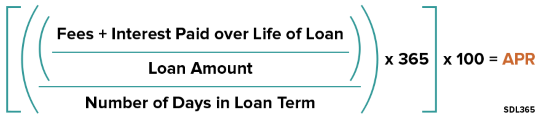

Annual Percentage Rate (APR) is the annual rate that is charged for borrowing. It is expressed in percentage, and it symbolizes the actual cost of funds in a year over the term of the loan. This indicator comprises the fees or any additional costs that are associated with the borrowing transactions;

To calculate an APR, you need to add the fees to the interest paid over the life of a loan, then divide by loan amount. Divide the obtained amount by the numbers of days (loan term), and then multiply it by 365 and by 100 to get the percentage value of the APR.

Generally, state laws are put in place to ensure that lenders make the lending process as transparent as it can be and that they disclose of all the terms and conditions as per regulations in force.

To protect consumers from predatory lending practices and credit discrimination, specific regulations were implemented at states’ level in addition to federal laws in force. In this context, the maximum loan amount allowed, the charges that lenders can apply to loans, the number of rollovers, the applicable fees and the number of outstanding loans that consumer can apply for at a given moment in time are all subject to states regulation.

The following table contains the general framework for establishing the APR and payday loan fees.

| State | Interest and permissible fees of payday loans |

| Alabama | max. 17.5% of the total amount of the loan |

| Alaska | 15% of the loan amount or max. $15 for each $100 (whichever is less) and $5 non-refundable origination fee |

| California | max. 15% of the face amount of the check |

| Colorado | max. 20% of the the first $300 borrowed |

| Delaware | No limit |

| Florida | 10% of check + verification fee that does not exceed $5 |

| Hawaii | 15% of the loan amount |

| Idaho | No limit |

| Illinois | $15.50 on every $100 and up to $1 fee on the loan base |

| Indiana | 15% fee on the first $250, 13% fee on a loan greater than $250 up to and comprising $400; 10% fee on loans that are more than $400 up to and comprising $500, |

| Iowa | $15 on the first $100, and max. $10 on subsequent $100 of the check |

| Kansas | 15% of the amount of the loan |

| Kentucky | $15 per $100 of the loan and max $15 fees |

| Louisiana | 16.75% of check value |

| Maine | 30% for loans up to $2,000 or a $5 fee for amounts financed up to $75; min. $15 for loans between $75.01-$249.99; or $25 loans of $250 or more. |

| Michigan | 15% on the first $100, 14% on the second $100, 12% on the fourth $100 and 11% on the sixth $100 |

| Minnesota | $0-$50 costs $5.50, $51- 100 costs 10% fee, $101-250 costs 7% or $10 minimum, $251- 350 costs 6% or $17.50 minimum and $5 fee for administration |

| Mississippi | $20 per $100 for check with nominal value not more than $250, $21.95 per $100 for check with stated value of more than $250 to $500 |

| Missouri | Total fees for initial loan and all renewals should not be more than 75% of the initial amount |

| Montana | max. 36% per annum |

| Nebraska | $15 per $100 of maturity value of the loan |

| New Hampshire | max. 36% per annum |

| Nevada | No limit |

| New Mexico | $15.50 per $100 and up to $0.50 fee on loan amount |

| North Dakota | 20% of loan amount |

| Ohio | 28% APR on outstanding principal of $1000, 22% APR on the overdue principal that exceeds $1000, 5% or $5 for late payments, 1% of principal fee on the loan of $15 on $500 or less loan, 1% of principal or $30 on principal above $500, $20 for the NSF fee |

| Oklahoma | $15 per $100 advanced up to first $300, $10 per $100 advanced for loan amounts in excess of $300 |

| Oregon | max 36% APR and a one-time $10 per $100 of loan origination fee |

| Rhode Island | 10% of the loan amount |

| South Carolina | 15% of loan amount |

| South Dakota | max 36% APR |

| Tennessee | 15% of stated value on check |

| Texas | 10% APR and fees |

| Utah | No limit |

| Virginia | 36% APR and 20% of loan proceeds and a verification fee that does not exceeds $5 per loan |

| Washington | 15% of loan amount on the first $500, 10% of $500 to $700 |

| Wisconsin | No limits, post maturity interest limited to 2.75% on a monthly basis |

| Wyoming | $30 or 20% per month on the principal balance |

The states where short-term cash loans are prohibited are Arizona, Arkansas, Connecticut, Georgia, Massachusetts, New Jersey, North Carolina, Vermont, Washington DC, Maryland, New York, Pennsylvania, and West Virginia.

Both the table and the list is not exhaustive. Please ensure you check other official and governmental resources to stay up to date with the regulatory changes regarding short-term lending.

For your convenience, click here and here to get all the necessary information regarding the regulations in your state. Ensure you check them before applying, as these regulations are subject to changes at any time.

In most cases, payday loans charge a dollar amount ranging from $10 to $30 per $100 borrowed amount. The fee, however, depends on the state law.

When you have your loans being transferred on prepaid debit cards, there could be additional fees. The fees can be for adding money to the card, for calling customer care services, when you utilize the card, regular monthly fee or for checking your balance.

There are state laws, which require payday lenders to give an extended repayment plan to borrowers, who are not able to repay the payday loans. The provisions differ across states as a state may or may not allow fees on a repayment plan. If a state allows an extended repayment plan, there might not be additional charges.

Also, if you do not repay the loan within the time it has been allocated, the lender can charge a late fee; this is dependent on your state’s law. Your bank account is in a position of imposing a non-sufficient funds charge if your electronic authorization isn’t paid because you have insufficient funds.

The maximum amount you can borrow is also subject to your state regulations. In most cases, a fee of $15 per $100 is applied, which equates to nearly 400% as an annual percentage rate for a loan of two weeks.

A payday loan rollover happens in case you are not in a position of paying your loan when it’s due. The loan lender allows you to pay the fees due, extending the due date of the loan. You then have to pay an additional fee.

Most states that allow payday loans also allow roll-overs according to the laws in force, but there are several states where rolling over a loan is prohibited. Read all the available resources before deciding to choose this option.

Annual percentage rate for payday loans can tend to be particularly high, and lenders’ fees might vary for every $100 borrowed.

The loan and charges are to be paid back in full at its assigned due date. Failure to pay, partial or late payment results in penalty fees and charges. Eventually, lenders can also contract third-party debt collection services for handling failing accounts. This can affect a borrower’s credit score negatively. Renewal policy depends on the lender and the state, which leads to extra finance charges.

Ensure that you read the documents before you sign a loan agreement; it will help you in spotting all the costs, charges, rates and fees before taking a loan.

Given all these specifics, short-term loans should be used only as a temporary solution, as it can become very expensive in case they are used not according to their purpose. For this reason, the short-term loans industry is heavily regulated on federal, state and local levels.

To help our customers stay up to date with the latest industry provisions, we provide multiple resources and educational materials, which aim at improving our clients’ understanding of the industry and their borrowing options. We also recommend using the Federal Trade Commission and the Consumer Financial Protection Bureaus websites, that are the two government agencies responsible for creating and enforcing the laws and acts that govern short-term lending.